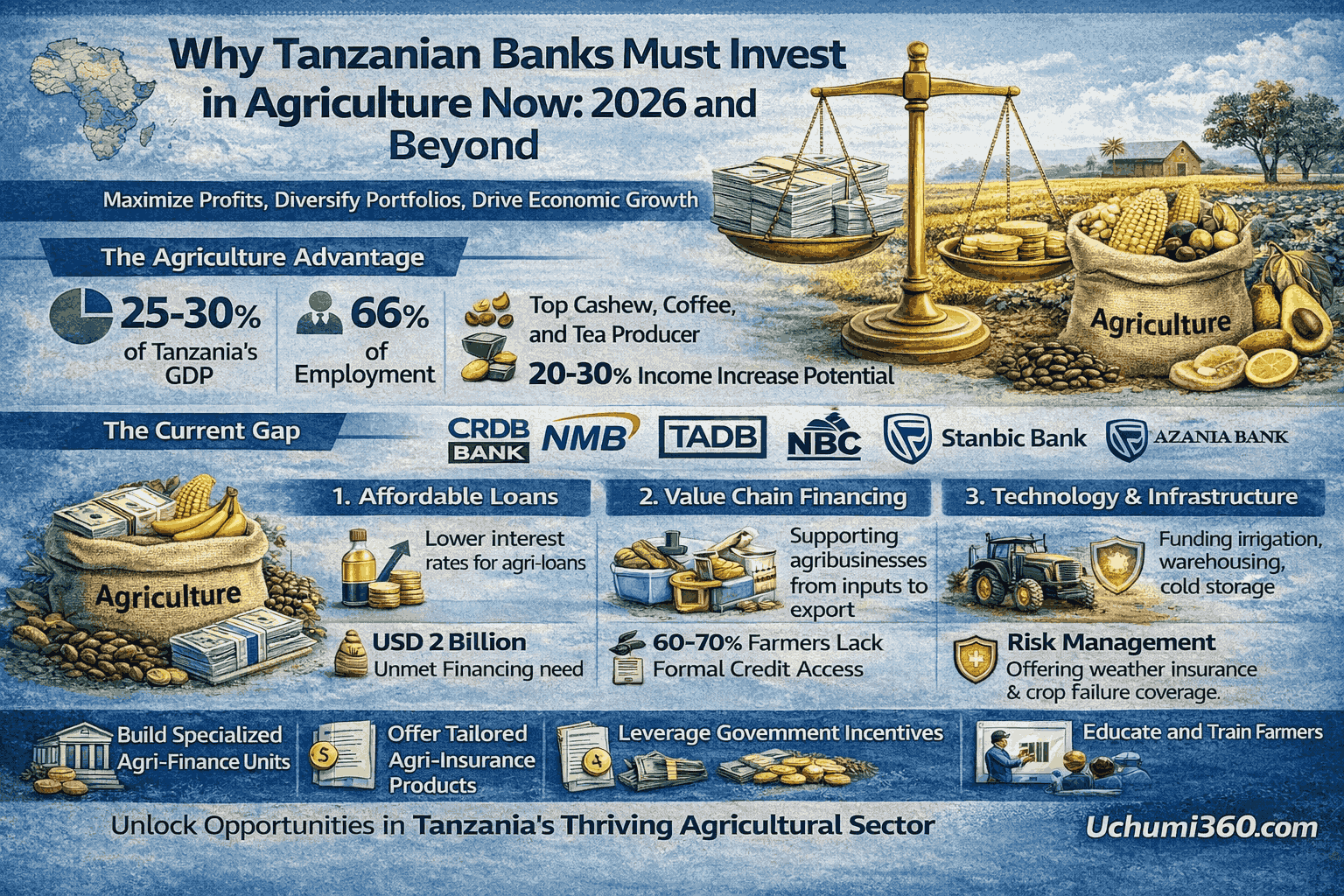

Why Tanzanian Banks Must Invest in Agriculture Now: A 2026 and Beyond

For forward-looking banks, agriculture is no longer a risky sideline it is a strategic growth frontier, capable of delivering financial, social, and policy-aligned returns simultaneously.

Tanzania’s agriculture sector is the backbone of the economy, contributing 26% of GDP and employing approximately 65% of the workforce, yet it continues to be underserved by the banking sector. In 2025, banks allocated less than 10% of total lending to agriculture, leaving millions of smallholder farmers and agribusiness SMEs undercapitalized. Meanwhile, agriculture exports exceeded $2.5 billion annually, with horticulture, fisheries, and livestock as the fastest-growing segments.

Looking forward to 2026 and beyond, Tanzania is entering a pivotal phase of agribusiness expansion. AfCFTA-driven regional demand, growing high-value exports, and investments in agro-industrial zones, cold-chain infrastructure, and digital farming are creating a market where agriculture can deliver predictable, scalable, and profitable returns for banks willing to rethink their investment approach.

For forward-looking banks, agriculture is no longer a risky sideline it is a strategic growth frontier, capable of delivering financial, social, and policy-aligned returns simultaneously.

The Current Gap in Bank Financing

Despite agriculture’s central role, Tanzanian banks have historically underinvested:

- Low Lending Share: Less than 10% of total bank lending goes to agriculture.

- Short-Term Products: Loans often fail to match seasonal cycles or long-term infrastructure needs.

- Perceived Risk: Banks cite climate variability, market price fluctuations, and lack of formal collateral as barriers.

- Urban Focus: Lending continues to favor trade, real estate, and services over rural sectors.

While some banks, including CRDB, NMB, and TIB, are expanding agri-finance programs, the scale is insufficient to match sector potential.

Why Banks Should Turn the Table Post-2026

1. Agriculture: A Massive Untapped Market

Millions of smallholder farmers and agribusiness SMEs are actively seeking:

- Working capital for seeds, fertilizers, and mechanization

- Financing for cold storage, processing plants, and refrigerated transport

- Export-ready infrastructure for Europe, the Middle East, and regional markets

Structured products for these clients can create repeatable, long-term revenue streams for banks.

2. Value Chain and Export Opportunities

High-value segments, now expanding rapidly, include:

- Horticulture: Avocados, mangoes, cut flowers

- Fisheries: Lake Victoria and coastal aquaculture

- Livestock and Dairy: Poultry, beef, and milk processing

Banks financing cold-chain logistics, aggregation hubs, and pack houses position themselves as essential partners in Tanzania’s growing export economy.

3. Risk Is Manageable With Modern Tools

Modern financial solutions allow banks to mitigate traditional agricultural risks:

- Value Chain Financing: Loans tied to confirmed buyers or cooperative groups

- Warehouse Receipt Financing: Loans secured against stored crops

- Crop Insurance: Protection against climate and pest-related losses

- Digital Lending Platforms: Real-time monitoring of farm output and repayment

Partnerships with development finance institutions (World Bank, AfDB, IFC) can further reduce exposure while scaling lending.

4. Policy Alignment and ESG Benefits

Investing in agriculture aligns banks with:

- Government priorities: SAGCOT, Big Results Now, agro-industrial clusters

- AfCFTA trade expansion: Facilitating regional exports

- Social impact goals: Financial inclusion, rural employment, and poverty reduction

This positions banks as strategic enablers of both economic growth and sustainable development.

5. Long-Term Profitability

Agriculture can be highly profitable when approached strategically:

- Design loans around seasonal repayment cycles

- Finance infrastructure linked to export contracts

- Diversify across value chains and regions to reduce risk exposure

With expanding domestic and regional demand, early-mover banks can secure long-term market leadership.

Strategic Steps for Banks Post-2026

- Target High-Potential Clusters: Focus on regions with high-output crops and strong export potential.

- Develop Tailored Financing Products: Seasonal loans, input financing, infrastructure finance, and value-chain solutions.

- Leverage Partnerships: Collaborate with cooperatives, agritech platforms, exporters, and development finance institutions.

- Integrate Technology: Use digital platforms to monitor production, manage repayment, and assess market trends.

- Promote Export-Linked Financing: Link loans to exporters and regional trade agreements for risk mitigation and higher returns.

The Road Ahead

Agriculture is Tanzania’s backbone, yet it has historically been underfunded by the financial sector. From 2026 onwards, banks have a unique opportunity to reshape the sector, delivering:

- Financial returns through structured lending and value-chain financing

- Social impact via financial inclusion, rural development, and job creation

- Strategic alignment with government policies and AfCFTA trade expansion

Bottom line: Agriculture is no longer just a development sector it is a profitable, strategic frontier. Tanzanian banks that embrace this opportunity now will define the future of agribusiness finance in the country.