Why Mortgage Uptake Remains Low in Tanzania’s Growing Cities

By combining innovative financial instruments, digital solutions, institutional funding, and supportive policy frameworks, Tanzania can unlock formal housing markets, increase homeownership, and reduce informal settlements.

Tanzania is experiencing one of the fastest rates of urbanization in East Africa. Cities such as Dar es Salaam, Mwanza, Arusha, and Dodoma are expanding rapidly, creating a surge in demand for housing. Despite this, mortgage penetration remains critically low, accounting for less than 1% of GDP, far below regional peers like Kenya, South Africa, or Rwanda.

Low mortgage uptake not only limits homeownership but also fuels the growth of informal settlements, strains urban infrastructure, and constrains opportunities for formal real estate development. Understanding the structural barriers, economic implications, and potential solutions is critical to unlocking Tanzania’s urban housing potential.

Structural Barriers to Mortgage Uptake

1. High Interest Rates and Credit Costs

Most Tanzanian banks charge mortgage interest rates above 15%, making long-term home financing prohibitively expensive for many households. Even when borrowers qualify, the cost of credit often exceeds the financial capacity of middle- and low-income earners.

2. Informal Employment and Income Instability

A significant proportion of urban workers are informally employed or self-employed, earning irregular incomes. Traditional mortgage lending relies on documented income, employment stability, and credit history, leaving a large share of the population excluded from formal housing finance.

3. Limited Long-Term Financing Options

Mortgages require long-term funding instruments. Tanzanian banks face challenges in raising long-term capital, partly due to underdeveloped capital markets and high liquidity risk. Consequently, they are unable to offer competitive mortgage terms or flexible repayment structures.

4. Lack of Collateral and Land Security

Many urban residents, particularly in peri-urban areas, lack legally recognized property titles, which banks require as collateral. Informal or contested land ownership restricts access to mortgage finance and discourages investment in formal housing.

5. High Upfront Fees and Down Payments

Mortgage products often demand substantial down payments, legal fees, and processing costs, which are unaffordable for most Tanzanians. Combined with limited financial literacy, these costs deter potential borrowers from entering formal housing markets.

Economic Implications

The low uptake of mortgages has broader economic consequences:

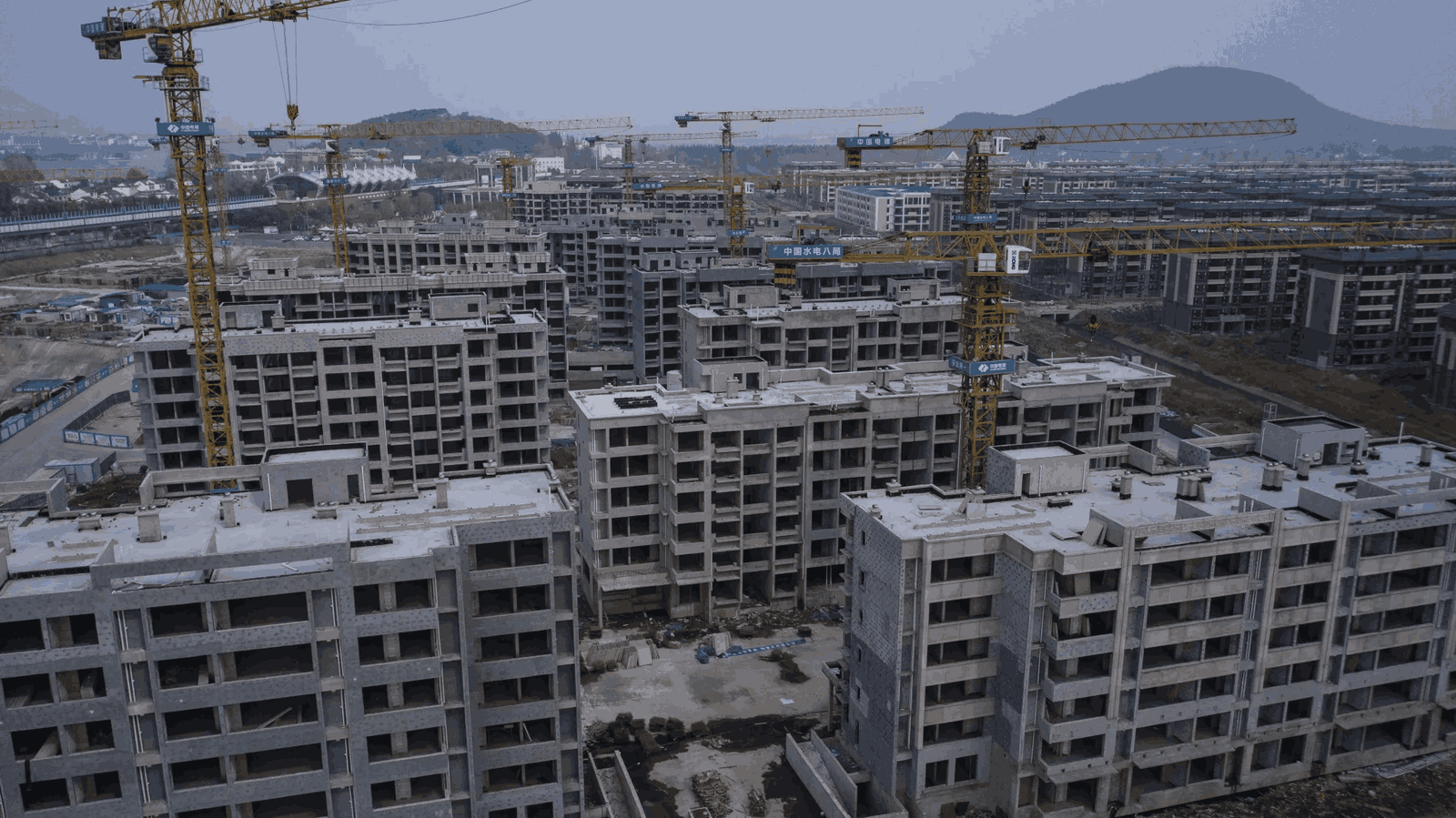

- Constrains formal housing development: Developers are hesitant to invest in large-scale residential projects due to uncertain demand for mortgage-financed homes.

- Limits construction sector growth: Construction is a major source of jobs, but slow mortgage uptake reduces investment and employment opportunities.

- Contributes to urban inequality: Wealthier households access formal housing, while low- and middle-income groups are forced into informal settlements lacking basic services.

- Reduces capital mobilization: Mortgages could channel domestic savings into productive long-term investments, strengthening financial institutions and capital markets.

Ultimately, the underdeveloped mortgage market hampers Tanzania’s efforts to provide affordable, adequate, and secure housing in its rapidly growing cities.

Way Forward: Expanding Access to Housing Finance

To address these challenges, Tanzania can explore innovative solutions and policy reforms:

1. Introduce Housing Microfinance Products

Short-term, smaller loans for incremental home construction can enable low-income households to gradually build formal homes. Microfinance institutions and digital lending platforms can play a key role.

2. Implement Government-Backed Mortgage Guarantees

Guarantee schemes can reduce perceived risks for banks, allowing them to lend to borrowers without formal collateral or stable employment. Public guarantees can expand credit access to underserved groups.

3. Mobilize Pension and Insurance Funds

Long-term institutional capital, such as pension funds and insurance reserves, can finance mortgages and affordable housing projects. This approach provides banks with stable funding while supporting formal housing development.

4. Leverage Fintech-Driven Mortgage Solutions

Digital platforms can simplify mortgage application, verification, and payment processes. Alternative credit scoring using mobile money and transaction histories can expand eligibility to the informal sector.

5. Streamline Policy and Regulatory Frameworks

Reforms to simplify mortgage approvals, reduce transaction costs, and enhance property registration can lower barriers to entry. Incentives for affordable housing developers can also stimulate supply.

Outlook

Expanding mortgage uptake is a critical lever for urban development, economic growth, and social stability. By combining innovative financial instruments, digital solutions, institutional funding, and supportive policy frameworks, Tanzania can unlock formal housing markets, increase homeownership, and reduce informal settlements.

As cities continue to grow, developing an inclusive, efficient, and accessible mortgage sector will be central to ensuring that urbanization translates into economic opportunity rather than social strain.